Deliverables

Developing a Cray Brand Strategy

This is a juicy assignment. The complex nature of enterprise b2b marketing is fascinating. And, there’s nothing more fun than helping a powerful company summit its next challenge. This proposal incorporates our experience in the commercial technology sector, with maturing brands, and your input, albeit limited, to date. We have more to learn from and with you and would expect to refine the details included here further as we work together.

Objective

To develop a Brand Strategy that supports the company’s growth deeper into the commercial sector.

As Cray’s strength lies in best-in-class technology developed by passionate employees and endorsed by extraordinary customers, a successful effort will:

- Celebrate your legacy in the public sector, research, and academia, as well as, the members of the existing Cray community, while also…

- Extending Cray into the enterprise marketplace by positioning the company beyond solely the historical definition of ”supercomputing” by leading the forward-leaning conversation about the future of supercomputing. (The concept of “supercomputing + big data” will be well considered in a full, open-ended exploration.)

Recommended Approach to Cray Brand Strategy

At One Degree, we use an approach we refer to as the 4Cs. However, every client and situation is different. Thus, this recommendation leverages what is useful in our process to fill information gaps and flexes according to the unique culture and challenges specific to your assignment.

Thus, this recommendation and research plan are structured to mine transformational insights specifically for Cray based on the the following Cs:

- Company

- Customer

- Category & Competition

- Culture

The following pages detail the depth and breath of questions that will be addressed for each C in the course of our process.

For Cray products and services Business Cray Brand Why do current Cray customers love Cray? Why did Cray rejectors choose a competitive supercomputer? How do we create appeal among high-performance-computing seeking enterprise segments across specific verticals? Including research among all, a subset, or clusters of the following, as appropriate: How can Cray capitalize on horizontal movements in cybersecurity and big data? What is the opportunity to up-sell current HPC workstation users? Of course, the enterprise technology purchase process is distinct from other categories and far more complex in a variety of ways: These nuances will be accounted for in the research methods and samples we recommend.Mining 4Cs : Company Exploration — Click to Expand

What is true for the product(s) and true for the brand that will grow the business?

Mining 4Cs : Customer Exploration — Click to Expand

How will we motivate new customers?

How does our offering compare to the competition? What are the market share data and trend lines? Where are there gaps? Why? Who does Cray compete with inside and outside of the category? What is everyone else saying and doing? Is there an opportunity that no one else has taken advantage of? How can Cray stake a unique claim to this?Mining 4Cs : Category and Competition Exploration — Click to Expand

How can Cray separate from the competition? How can we reframe the category in our favor?

What is the future of supercomputing? Of Big Data? What’s the future of supercomputing + big data? What is the future of cybersecurity? Which brands and personalities are the loudest voices in these spaces? How are new consumption models diluting the once-custom supercomputing market? What are the assets and limitations of leading enterprise brands such as HP and Dell in the supercomputing space? How is the term “supercomputing” being co-opted inside and outside the category and what are the implications of this for the true supercomputing companies?Mining 4Cs : Culture Exploration — Click to Expand

How can Cray lead the conversation?

Proposed Methodology: Cray Deliverables in Three Phases

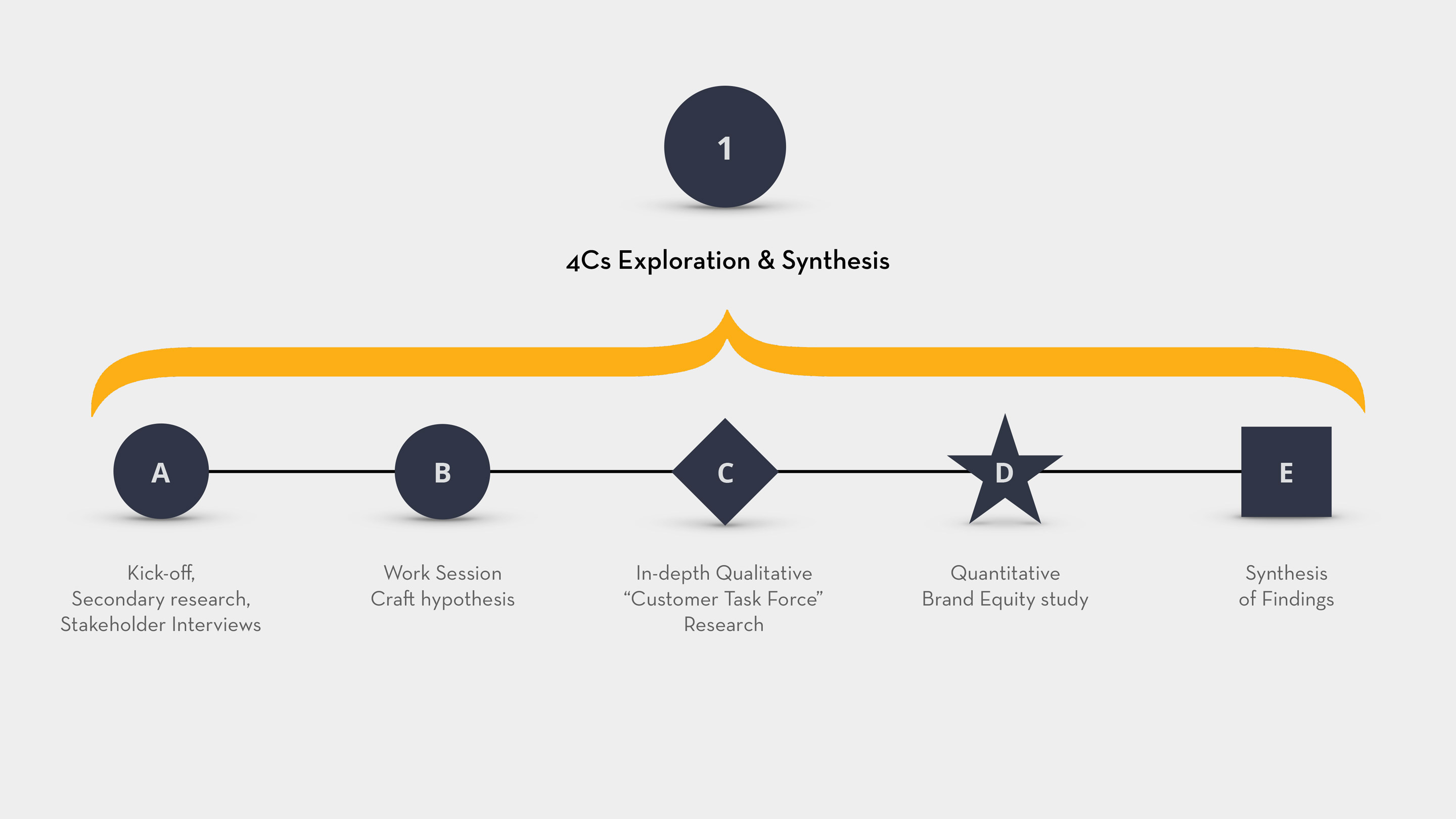

Phase 1 : 4Cs Exploration & Synthesis

Company Kickoff : Group meeting(s) at Cray with marketing and appropriate leadership to introduce and review details of the project. Outputs : Secondary Research : Audit of existing Cray materials and research on the business, go-to-market activities to date, and the category. Review secondary and syndicated research sources to gain market share data, insight into which players are moving into the space, how and why, and to identify trends in relevant areas, etc. Outputs : Timing : < 1 Week Combined Stakeholder Interviews : In-depth-Interviews (IDIs) with stakeholders internally and externally (for example, employees, industry analysts, partners, etc.) to capture perspectives on the market opportunity, Cray’s business, and the hurdles to overcome. (Efficiently gain knowledge while also reinforcing these stakeholders’ ownership of the process and consensus on the current state.) Assumes some/limited Cray site visit(s) e.g. St Paul/Chippewa Falls and/or Pleasanton/San Jose, and Skype interviews with key staff in Europe, APAC. Outputs : Timing : 1 Week A : Kickoff and Immersion — Click to Expand

Following the Company and initial Category immersion, we will hold a work session with Cray’s marketing leadership team to: Outputs: Timing : 1-2 Days B : Work Session with Cray — Click to Expand

As noted earlier, the complex and multi-faceted nature of the enterprise technology market requires a unique research methodology. We’ve developed a “Customer Task Force” approach to gain the truest understanding of the roles and dynamics of this space. We approach it as a B2B ethnography to unpack the complex relationships involved in the purchase of a.) a very expensive and potentially platform-changing system, with b.) a hyper-extended sales cycle, and c.) a review and purchase process involving diverse decision recommenders, makers, and influencers. We thus refer to the often-informal review and decision committee inside companies as their “task force”. This approach recognizes that a Brand Strategy that effectively drives business will inherently be tailored at the executional level according to job title and vertical market, yet also shape individual efforts in such a way that they accrue to a singular Cray brand. Therefore, we use a combination of one-on-one interviews plus Task Force group sessions to uncover needs and pain points, sales barriers, and other eco-system dynamics for the targets as individuals and as a Task Force. Qualitative Research Methodology : We will structure each company session in two parts: the first being in-depth interviews (IDIs) with individual members of the company team, followed by a 1-hour task force-wide discussion. We propose conducting this research among three specific segments of customers, 3 each for a total of 9 accounts/customers (but many more individuals): Outputs: Timing : 3-4 Weeks A final discussion guide will be developed and reviewed with Cray in advance of this research. But, below are examples of key discussion areas we will explore: Cray Customer Interviews Vertical Segment Prospect Interviews Rejectors or Competitive Customer InterviewsC : In-depth Customer Task Force Research — Click to Expand

Adjustments or additions to the Brand Equity statement drafts, for use in subsequent quantitative study

Once the qualitative is nearing completion, we also recommend executing an online quantitative Brand Equity study to validate what we perceive to be Cray’s Brand Equity factors. These will be fielded among the same 3 audience segments as the Task Force qualitative: Outputs: Timing : 2-3 weeks (including debrief on findings) * Note: given the specialized nature of your target, this will likely not be a large enough sample to be statistically stable, but it will be quantitative in nature and solid in provide directional findings.D : Quantitative Brand Equity Study — Click to Expand

Following the internal immersion and qualitative research, the One Degree team will collect and synthesize our findings. (We will not wait on the quantitative study data as that will be factored in at the next stage.) During Synthesis, we will build enterprise Customer Sales Cycle(s) diagrams. These maps will identify customer trigger and pain points, opportunities for persuasion/influence, as well as decision-maker/influencer roles and experiences. These customer lifecycle details will influence the full communications messaging plan Cray has described in later activation and amplification workflows. But, near term, will reveal the richest veins of opportunity — whether by vertical market, business process, or industry dynamic (e.g. cyber-security.) Outputs: Timing : 1 WeekE : Synthesis of Findings — Click to Expand

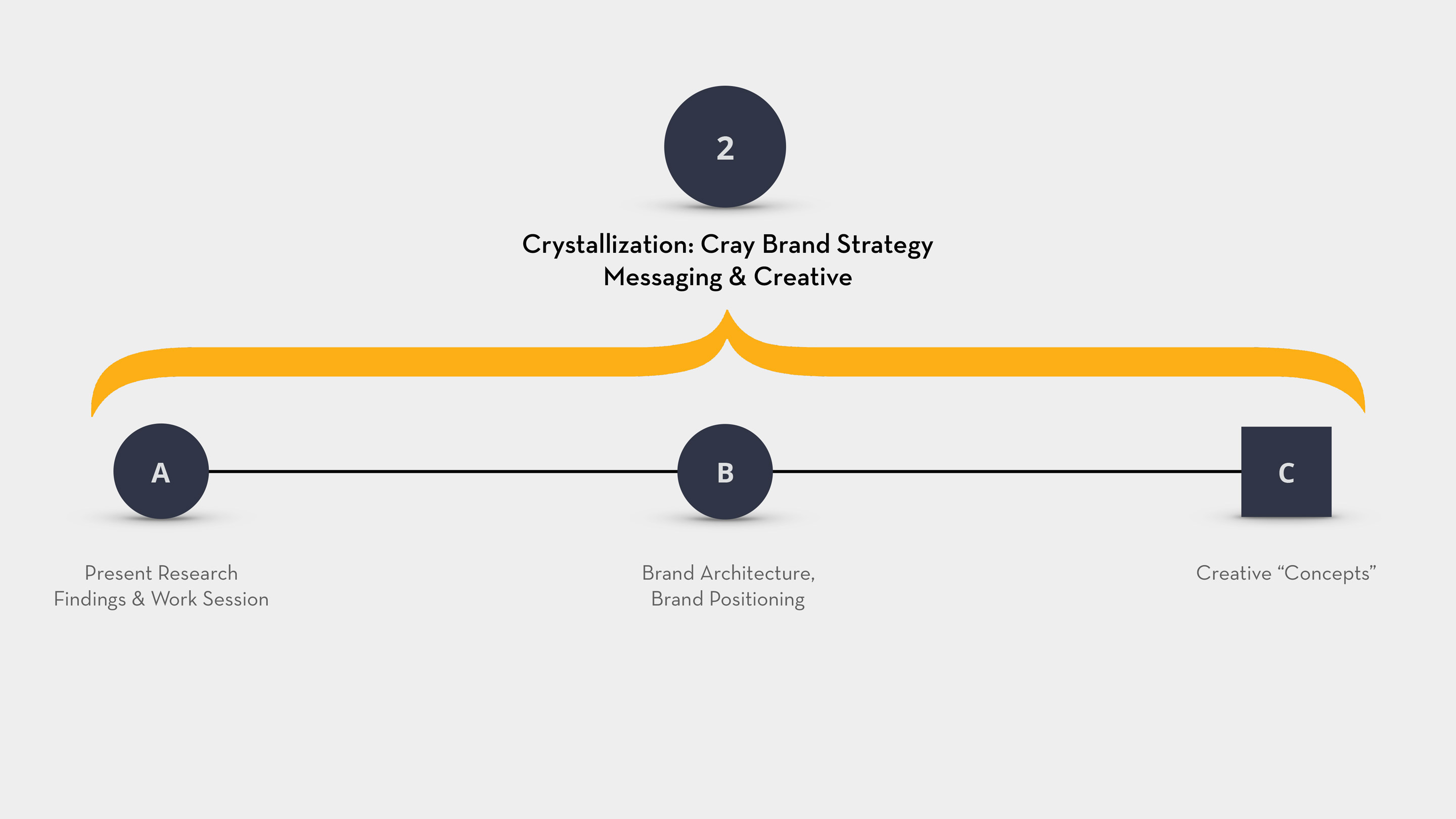

Phase 2 : Crystallization of Brand Strategy

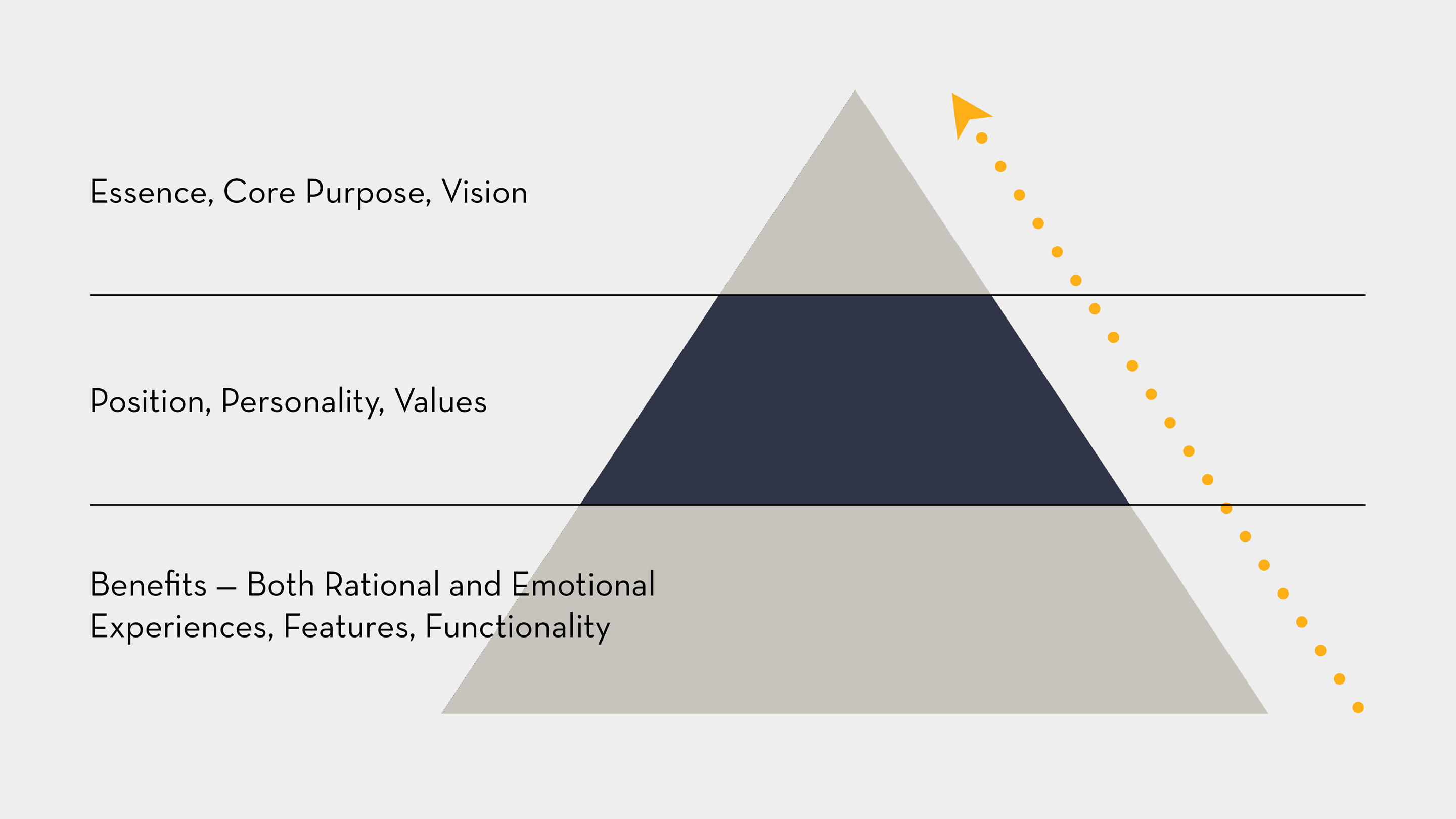

Also, importantly, this debrief will be combined with a work session designed to encourage team participation in the process and, accordingly, buy-in to the implications of the evolving Brand Strategy. We do this through a workshop-style session drafting a Cray Business Model Canvas. As a team, we will build on the new messaging while also looking at how Cray might improve internal, partner, or other operational and go-to-market alignment that might otherwise impede growth. This due diligence ensures the brand elements have a solid foundation in the broader Cray business plan (and vice versa) and continues development of internal consensus. Outputs: Timing : 1 Full Day Next, we will be ready to articulate the Cray Brand Strategy. This step can be done with the core marketing team only, or the broader company leadership… the goal being to ensure top to bottom alignment. In our experience, this works well if we start by sharing an executive summary of the research findings and then lead a focused discussion on Cray’s Brand Essence, Core Purpose and Vision. Outputs: Timing : 1/2 Day With a clear and approved high-level Brand Architecture, we will formalize the new Cray Brand Positioning statement. We use a variation on Geoff Moore’s classic value positioning rubric: Outputs: Timing : 1 Week While a Brand Architecture and Positioning are useful to the marketing team, they can be confusing to other audiences. Thus, as Brand Strategy crystalizes, our creative folks will start working on ways to present the idea in a more tangible and readily understood form. For example, we may develop one or a combination of the following: an advertising “tagline,” a sample press release announcing a future Cray customer win, a mock up of the cover of Forbes magazine or CIO in 2018 featuring the latest Cray success, or a video anthem, etc. The cost to produce this work can vary greatly depending on to whom and how we plan to expose the stimulus. (This recommendation assumes quantitative validation conducted online and, accordingly, requires that we design/produce creative objects that can be shared effectively in that medium.) We recommend determining the medium when we know much more about Cray and about the idea we are trying to communicate. Outputs: Timing : 1-3 Weeks (depending on level of completion required)A : Present Research Findings & Brainstorm Opportunities — Click to Expand

We will begin Phase II with a full report back to the core marketing leadership team (and other audiences, as appropriate) on the findings of the 4Cs investigation.

We will begin Phase II with a full report back to the core marketing leadership team (and other audiences, as appropriate) on the findings of the 4Cs investigation.

Shaping Cray Brand Strategy, Part 1 — High-level Architecture — Click to Expand

B : Shaping Cray Brand Strategy, Part 2 — Brand Positioning — Click to Expand

For ____________________________________ (target customer)

Who ___________________________________ (statement of need or opportunity)

Our ___________________________________ (product/service/name) is the ____________________________________ (category)

That _______________________________________________________ (statement of benefit).

Unlike ______________________________________________________ (competitive context)

We are the ___________________________________________________ (unique differentiation/evidence).

C : Design Brand Concepts — Click to Expand

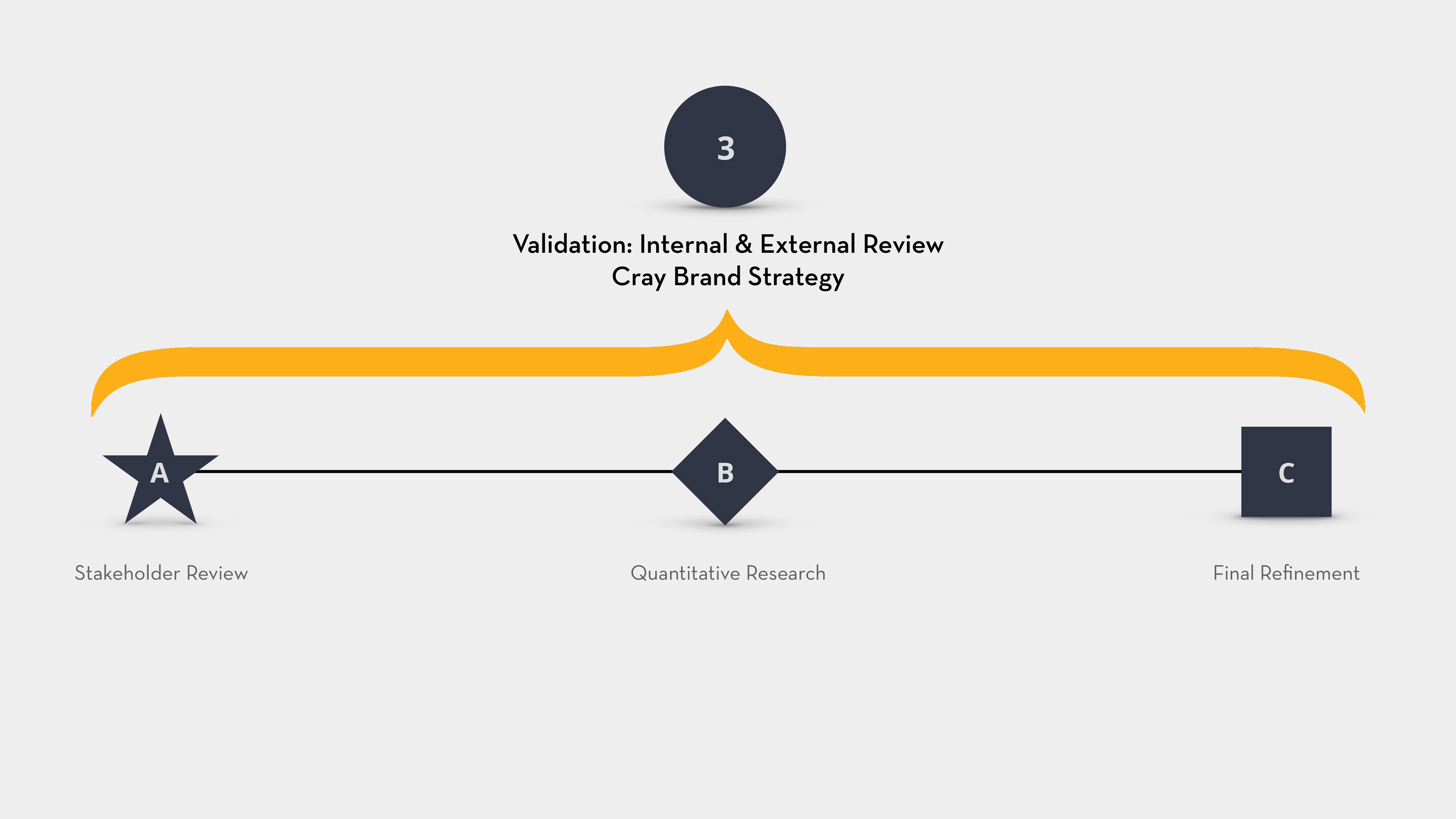

Qualitative Validation : We have found that a relatively quick and qualitative review of the Brand Strategy and and associated creative designs pays big dividends. The central objective is to understand if the Brand Strategy is believable, significant and convincing. We will share a strategy line, positioning statement, and 2-3 creative concepts to respondents. Thus, it’s important that the structure of this review is open-ended to uncover any “why’s” behind what we learn. Pending that feedback, we may want or need to tweak either the messaging or the execution one final time before quantitative review. Outputs: Timing : 1 Week Quali/Quantitative Validation is the cute name for smart research that combines both the evidence sought by “quant” and the insight needed for making changes if indicated by the results (thus the “quali”). In other words, it will be a mainly quantitative study with several open-ended questions to allow respondents to add detail or explanations. For example: if they have checked an answer saying the new line or concepts do not seem credible coming from Cray, we can ask them “Why?” and provide space for a full response (vs. guessing at a limited number of possible answers.) We propose this method, which can be more or less expansive again depending on Cray’s needs, as an online study that allows us to gather feedback from a larger pool of Cray stakeholders, employees, and as feasible, existing or potential customers. Outputs: Timing : 1-2 Weeks Once we have the final feedback, we will make remaining adjustments (potentially benefiting from another iteration of quant’ or qual’ feedback.) The conclusion of this phase is by default the beginning of the next — Brand Activation and Amplification — as noted in the initial RFP. As our cases and client references will attest, we have a great deal of experience building out top-to-bottom communications plans, logo and brand standards guidelines, and all manner of go-to-market materials and templates. We would say that that’s when the fun starts … except that we truly enjoy the process covered here just as much. Outputs: Timing : 1 WeekA : Stakeholder Review — Click to Expand

B : Quali/Quantitative Research — Click to Expand

C : Final Refinement — Click to Expand

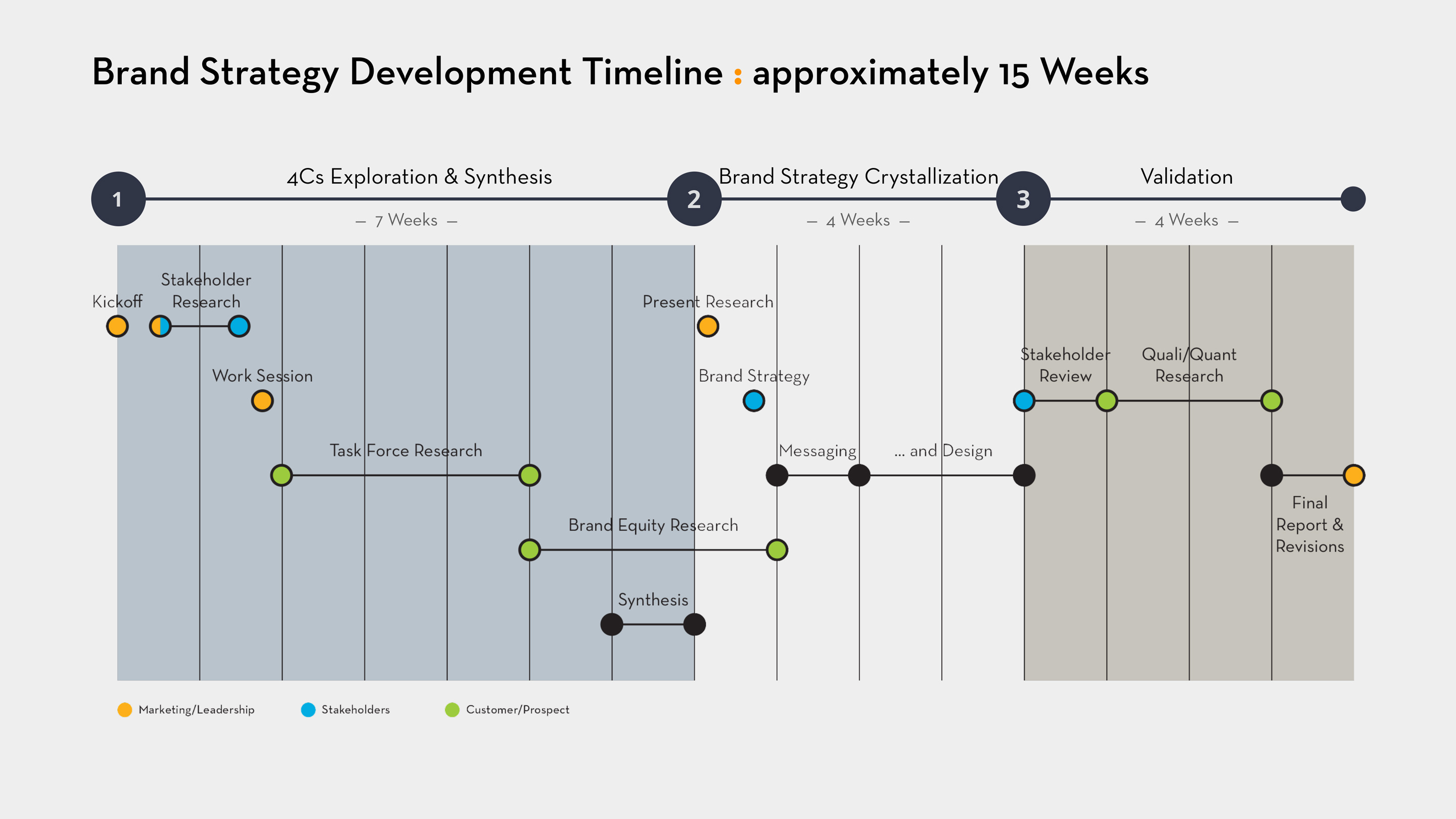

Project Timing

We have developed this initial schedule balancing the value of rigorous research and organizational consensus-building against a faster, leaner approach. While we can work faster and/or cut down on some of the qualitative research timing, we’re not sure that can be done and gain the depth of insight you seek. Of course, we will tailor the plan to eliminate some steps if they seem like overkill or lengthen others to accommodate internal schedules. This will be done with input from you. (For confidentiality: detail of our costs and fees are included only in the pdf.)

Recommended Schedule — Click to Expand